You planned accordingly for the future and opened your Pooled Special Needs Trust (PSNT). Now what? What are the most vital strategies you need to know to help successfully manage your trust and get the most out of it?

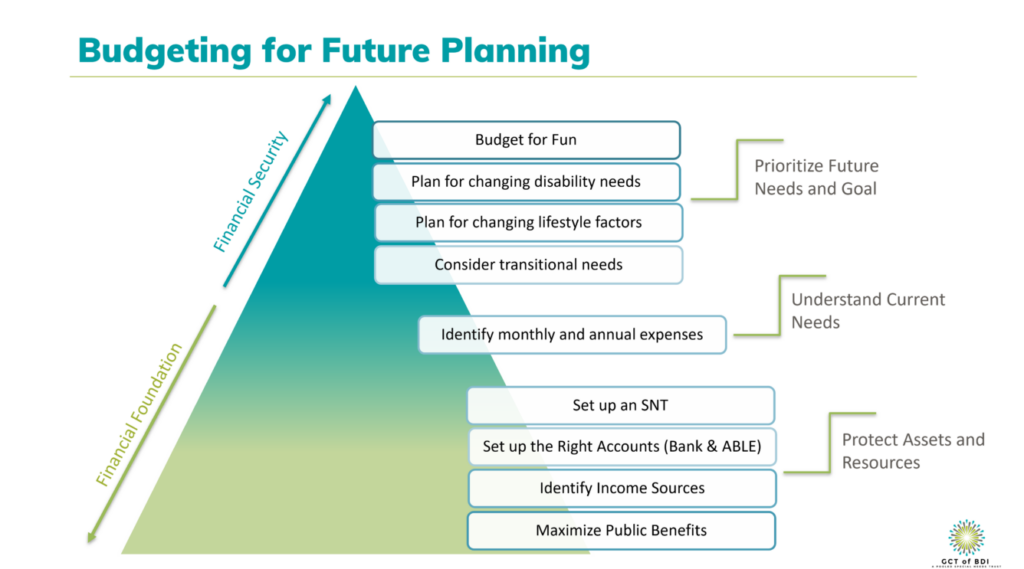

Understanding the significance of budgeting and future planning is crucial, especially for individuals living with a disability or those caring for a loved one with a disability. Thorough and careful planning is a protective measure to maintain eligibility for benefits and maximize their utilization. Effective planning is essential to prevent exceeding asset limits set by Medicaid and Social Security Insurance (SSI). Establishing a budget becomes increasingly important as the costs of care rise, and when there is a growing demand for additional support and services.

In this article, we cover:

- Available Benefits

- Understanding Income

- Benefits of PSNT and ABLE accounts

- What is a Financial Needs Assessment?

- How to develop a budget document

- How to monitor and evaluate changing needs

- Start Budgeting with Our Free Template

Know What Benefits are Available

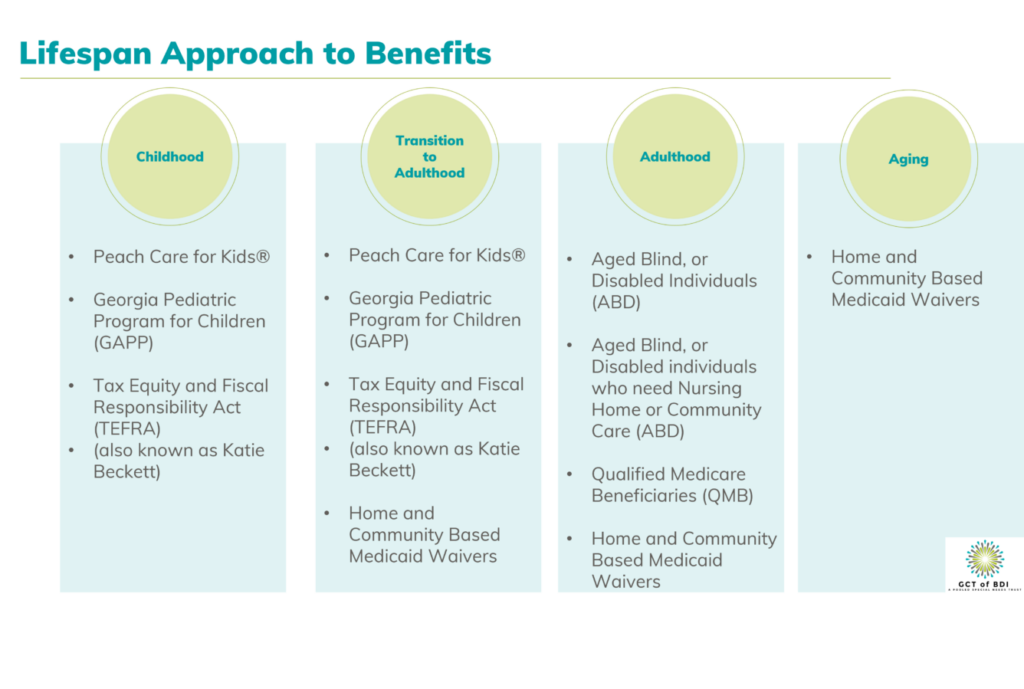

The first important aspect of planning a stable financial future is understanding the available benefits. The table below lists all the resources available from childhood to late adulthood.

1. Federal Benefits

There are multiple federal benefits available to those living with a disability. They include Social Security Income (SSI), Social Security Disability Insurance (SSDI), Social Security Disability Insurance (SSDI) Disabled Adult Child (DAC), and Medicare. If you are planning on applying for any of these benefits or are already in the process of applying, read our ultimate guide to a smooth SSI application process.

There are additional benefits that you may want to consider depending on your situation and current needs.

Among these is the Plan to Achieve Self-Support (PASS). It allows an SSI recipient to save money for an educational or vocational goal in a separate account, which is not counted as a resource or countable income when determining their SSI payment. For example, setting aside $100 per month towards tuition for a training program is a strategic use of this benefit.

Another valuable resource is the Impairment Related Work Expense (IRWE), which covers out-of-pocket expenses related to one’s disability, such as medication co-pays, special equipment, and transportation costs associated with work.

For those under the age of 22 attending school, the Student Earned Income Exclusion (SEIE) provides relief by allowing the exclusion of a specified amount of gross earned income reducing the countable earned income.

Furthermore, staying informed about the 2024 SSI Exclusion Amount of $2,290 per month, with a yearly maximum of $9,230, is crucial for optimizing financial planning.

2. Georgia Medicaid Benefits

If you are a resident of of Georgia, you may want to explore available state benefits.

PeachCare for Kids is a program designed for low-income families, aiming to provide coverage for individuals under the age of 18 who do not have other health insurance. To meet the eligibility requirements, income is assessed based on 247 percent of the Federal Poverty Guidelines for U.S. citizens or those falling within an eligible legal immigrant category. Verification of income and proof of citizenship are required when applying for this benefit.

The Tax Equity and Fiscal Responsibility Act (TEFRA), also known as Katie Beckett, is another option for those who qualify. This benefit is available to children under 18 years of age who have a long-term disability or complex medical needs. This benefit allows eligible children to receive services at home instead of in an institution. Documents needed to apply include a physician statement regarding medical necessity or level of care and a physician statement regarding monthly service costs.

While these benefits are available to young children, there are several options for individuals 65+ or over 18 years of age, blind, or totally disabled. Among those benefits are Aged Blind, or Disabled Individuals (ABD) that may provide in-home or out-of-home support respectively. Qualified Medicare Beneficiaries (QMB) is also an option.

ABD with in-home supports helps those who are aged 65 years or older, are blind, or are disabled. To qualify, the individual must be a U.S. citizen or qualified immigrant and a Georgia resident. To determine if an individual qualifies for this benefit, income and assets will be taken into consideration. This includes total gross monthly income from all sources, including Social Security benefits, pensions, and more. If the applicant lives with a spouse, the spouse’s income is also considered. Countable assets encompass real property, bank accounts, investments, inherited property, and life insurance over $2,000. As of 2011, the monthly income limit for SSI is $943 for individuals and $1,415 per month for an eligible couple. ABD also provides the option for out-of-home care for qualified individuals. To qualify for long-term care in an institution, the individual’s income must be under $2,829 per month. Their total assets should not exceed $2,000. The individual needs to qualify for a nursing home level of care. Verification of Income, proof of citizenship, residency and identity are needed to apply for either of these programs.

Depending on the individual’s income, they may qualify for a Medicaid program known as QMB. The QMB program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries. This consideration adds an extra layer to the planning process, emphasizing the need to explore all available options for comprehensive healthcare.

3. Georgia Medicaid Waivers

Medicaid waiver programs allow people who are elderly or have disabilities to live in their home or community instead of an institution such as a nursing home or intermediate care facility. There are several waiver services programs.

The Community Care Services Program (CCSP) program is for elderly individuals unable to live alone, individuals who require assistance in daily living. To be eligible, the monthly income of the individual must be between $400 and $2,523 per month. Individuals benefiting from the CCSP program can participate in only one waiver program at a time. Verification of income and assets, verification of citizenship, and doctor approval for intermediate nursing home care are needed to apply.

Services include:

- May cover physical,

- Occupational or speech therapy,

- 24-hour personal care supervision,

- in-home, 24-hour electronic two-way communication system that calls for help in an emergency,

- Home-delivered meals,

- In-home nursing and therapy services,

- Out-of-home respite care to provide temporary relief for the primary care giver responsible for full-time care, as well as

- In-home services such as personal care, meal preparation, light housekeeping, shopping, and in-home respite services.

NOW and COMP Waivers are for individuals living with intellectual and/or developmental disabilities who require an intermediate care facility. NOW offers services and support to allow people to continue living on their own or in their family home and participate in the community. COMP serves individuals living with intellectual and/or developmental disabilities who require more intensive residential care. To apply by mail or in person, you need proof of citizenship, social security and Medicaid card and relevant psychological reports, and/or documents from schools or other intermediate care facilities The services covered under the NOW/COMP Waiver include:

- Community Access Services

- Assistance with ADLs

- In Home and Community Support

- Residential Placement Supports (If applicable)

- Supported Employment Services

- Behavioral Support Services

- Adult dental, nursing, occupational and physical therapy services.

- Speech and language therapy

- Transportation and Vehicle Adaptation

- Specialized Medical Supplies and Equipment including Nutritional supplies can also be covered by the program.

See the full list of eligible services.

Among the other waiver programs are the Independent Care Waiver Program (ICWP), ICWP is for individuals with severe physical disabilities who are between the ages of 21 and 64 and have a severe physical impairment that substantially limits one or more activities of daily living and requires assistance.

Service Options Using Resources in Community Environments (SOURCE), To be eligible for SOURCE, the individual must be either 65 and older or under 65 and disabled, having a chronic condition that has been present for at least three months. Adult day care, alternative living services, personal care, home delivered meals, and respite care for family caregivers can be covered under this program.

The Georgia Pediatric Program (GAPP). helps children under 21 who are medically fragile to receive nursing care and/or medically necessary personal care support.

Other programs to consider include:

- Supplemental Nutrition Assistance Program (SNAP)

- Public Housing (Housing Vouchers)

- Temporary Assistance for Needy Families (TANF)

- Pell Grants (Post-Secondary Education)

- Low Income Home Energy Assistance Program (LIHEAP)

- Weatherization Assistance Program

Understand Incomes and What Counts as an Income

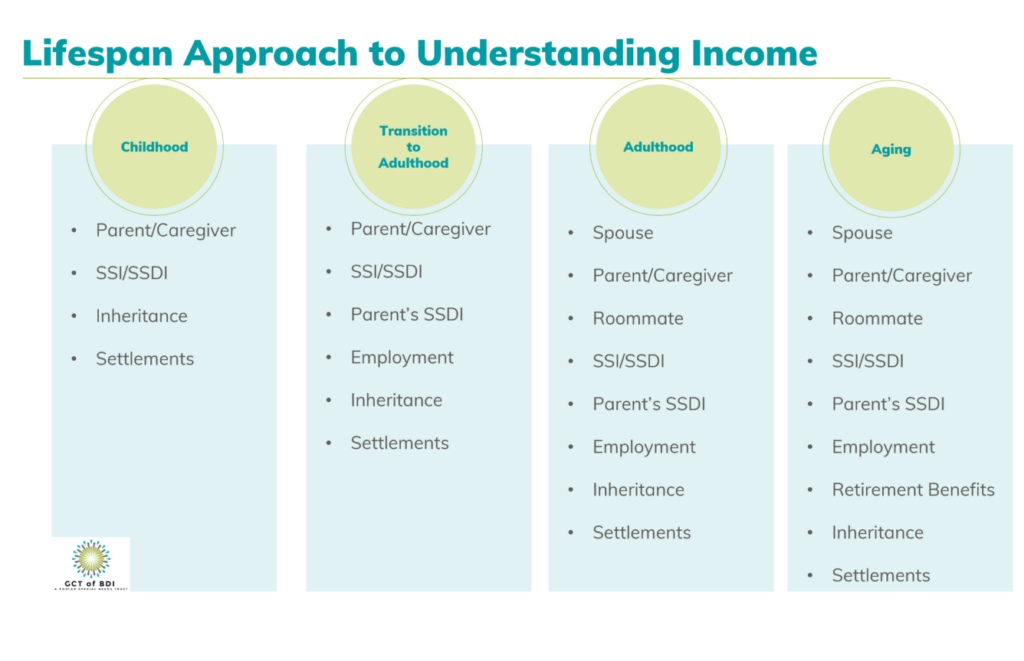

The next step in planning a stable financial future for a person living with a disability involves understanding income and mastering strategies to protect benefits while also maintaining a life with dignity and happiness.

What is Income?

An income is defined as any funds that a person earns or is gifted. This includes paychecks, cash gifts, life insurance, and in some cases, prepaid burial insurance, life insurance payouts, inheritance, court settlements, and child support.

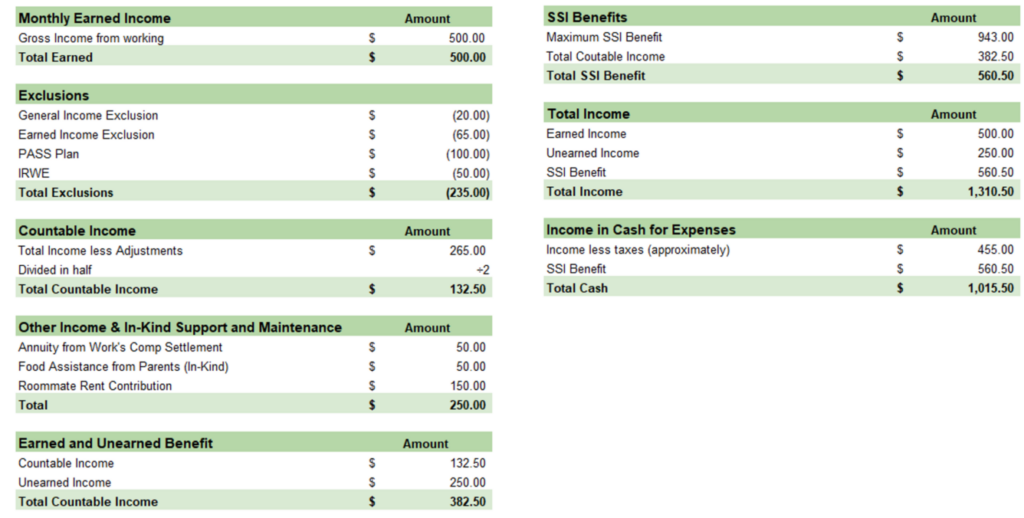

SSA first applies a few exclusions and then counts $1 for every $2 of income from employment.

When it comes to General Income Exclusion, SSA will exclude the first $20 of earned or unearned income a person receives. As for the Earned Income Exclusion, SSA will exclude the first $65 a person earns from working.

What is an Asset?

An asset is defined as any item of value that a person owns or is gifted. This may include cash, bank account(s), stocks, U.S. savings bonds, land, life insurance, and in some cases, prepaid burial insurance, personal property, life insurance payouts, inheritance, court settlements, child support, vehicles (including recreational vehicles), anything else the individual owns that could be changed to cash and used for food or shelter as well as deemed resources.

Explaining the Four Types of Income

- Earned income is from working, while unearned income comprises benefits or cash from friends and relatives. Earned Income includes wages, net earnings from self-employment, certain royalties, honoraria, and sheltered workshop payments.

- Unearned Income encompasses all income not earned, such as Social Security benefits, pensions, state disability payments, unemployment benefits, interest income, dividends, and cash from friends and relatives.

- In-Kind income refers to free food or shelter, and it can be counted if someone helps pay individual’s rent. SSI can consider this income dollar for dollar, potentially reducing the total amount received from SSI. In-Kind Support and Maintenance (ISM) includes mortgage payments (including property insurance required by the mortgage holder, real property taxes, rent, heating fuel, gas, electricity, water, sewer, garbage removal. Paying for these items may reduce your Supplemental Security Income (SSI) benefit dollar-for-dollar up to a maximum of one-third of the maximum SSI benefit.

- Deemed income arises when another person’s income is considered and counted. This deeming applies only if the individual lives with a spouse, parents, or a sponsor.

Countable Vs. Uncountable Income

Countable income is considered monthly, and all types of income are taken into account. What counts towards your income? In terms of earned income, wages, net earnings from self-employment, certain royalties, and honoraria. Unearned Income comprises all income not earned, including pensions, unemployment benefits, interest/dividends income, and cash gifts. Moving beyond these, In-Kind Income extends to all forms of support received by you or your household from any source that can be utilized to meet basic needs for food or shelter. GA Medicaid also includes clothing in this category. Meanwhile, Deemed Income is the income received by your spouse, parents, or sponsor (if a resident alien) with whom you reside. When does Deemed Income no longer apply? This occurs when the individual no longer lives with a spouse or parent, when a disabled or blind child reaches age 18, or when an alien’s sponsorship ends.

Now that we have established what counts towards income, it is important to understand what uncountable income is. For Earned Income, certain exemptions exist, such as the first $20 of most income received in a month, the initial $65 of earnings plus one-half of earnings over $65 (applicable to employed individuals), and income set asides under a Plan to Achieve Self-Support (PASS). Additionally, special rules apply for blind individuals who are working and students, as well as impairment-related work expenses. For Unearned Income, several sources are considered exempt, including income tax refunds, GA Medicaid, adoption assistance payments, child support, veteran’s benefits, and TANF (formerly AFDC) benefits. In-Kind Income that is not countable encompasses assistance based on need funded by a State or local government or an Indian tribe. This includes food or shelter assistance like HUD, food stamps, and energy assistance. In-Kind support other than food and shelter, like medical expenses or telephone bills, is also uncountable income.

Knowing the difference between countable and uncountable income is vital when receiving benefits.

When to Consider Pooled Special Needs Trusts and ABLE Accounts

Pooled Special Needs Trusts (PSNT) are designed to preserve public benefits of children and adults living with disabilities while providing a financial vehicle for future planning. Special Needs Trusts are essential for any individual who receives needs-based public benefits, such as Medicaid or SSI, and who may be in receipt of a lump sum. Consider using a PSNT for settlement agreements, life insurance, inheritance, and large cash gifts. One restriction to be aware of is that using funds for housing, utilities, and food are counted as in-kind support and maintenance. There’s no account balance limit for PSNT.

The ABLE account, also known as STABLE in Georgia, is designed to provide individuals with a safe harbor to protect their resources. It is especially beneficial for people who receive social security or use Medicaid since one of the criteria to maintain this eligibility is to have no more than $2,000 in resources. Georgia STABLE Accounts allow individuals with disabilities to save and invest up to $18,000 annually, and up to $14,580 more for working individuals, without affecting eligibility for other benefits programs. Consider an ABLE account for excess funds from employment, excess funds from SSI/SSDI, family member contribution to living expenses, and small financial gains. Qualifying expenses include any expense related to improving the quality of life for the individual that is not covered by their benefits. These expenses encompass living expenses, education, housing, transportation, employment training and support, assistive technology, personal support services, health prevention and wellness, financial management, administrative services, legal fees, and oversight and monitoring. Make sure you keep track of all your expenses, as the IRS may request those documents.

When to use a bank account? It is a good option to deposit funds from employment and SSI/SSDI awards. There are no restrictions on spending and account balance limits. However, anything over $2,000 becomes a countable resource and will impact benefits.

Initiate a Financial Needs Assessment

The next step in the process is to complete a financial needs assessment. Make sure you account for the individual’s needs based on age and specific situation. Typically, costs peak in adulthood with housing and healthcare costing the most. When planning, figuring out those costs and when the increase will set, builds a foundation for a stronger financial plan.

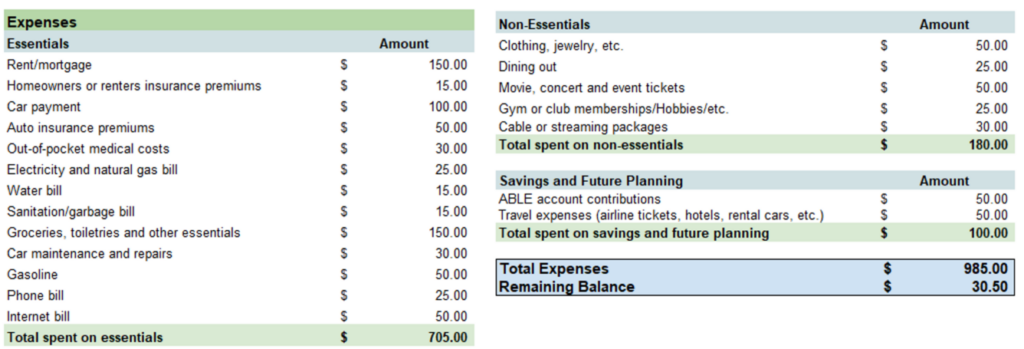

Step 1: Create a List of Monthly Expense Needs

Begin by establishing essential and non-essential monthly needs. Essentials include fixed expenses that do not change from month to month like rent or mortgage and a car payment. Flexible expenses might change from month to month. These include utilities, food, phone, medical costs, fuel and transportation, insurance, personal care, cleaning supplies.

Account for the non-essential income which may include things like cable, internet, and streaming services, credit card payments, gaming and game downloads, hobbies, eating out, other personal items like makeup or cologne, movies, music purchases, and other entertainment.

Step 2: Create a List of Annual Expense Needs

Begin by including the essential items you will need each year. This may include specialized equipment, dental and vision needs, vehicle registration and maintenance, mortgage taxes, home repairs and modifications, clothes, and accessories. Make sure you consider all the disability-related expenses. Plan for an annual vacation and college savings as well.

Step 3: Create a List of Future Expense Needs

It’s important to understand the evolving health requirements and consider the type of health insurance suitable for the individual—whether it’s Medicaid, Medicare, Medicare Advantage, Private, or another option. Additionally, identifying medical expenses not covered by insurance is essential for proper financial planning. Understanding the individual’s employment status, whether they work or rely solely on benefits and/or trust resources, plays a vital role. If employed, determining their retirement plans becomes a key consideration. The choice of living arrangements, such as moving independently, having a roommate, or continuing to live with family, are also important aspects of successful financial planning. Assessing potential modifications to the home or vehicle for enhanced accessibility is also vital. Deciding how often to purchase a new vehicle and considering the acquisition of a prepaid burial plan are additional aspects that contribute to comprehensive health and financial planning.

Step 4: Develop a Budget

Now that you know what your monthly and yearly expenses are, it is time to develop a budget.

First, calculate the income for an individual who is working. Use the table below to create your own calculations.

Next, calculate expenses. Use the example below to build your own budget.

Budgeting Tips

Start by creating a budget before the month begins. This will give you a clear understanding of your expenses. Set a bill calendar to stay on top of due dates and avoid late payments. Practice budgeting to zero. Choose the right tools, whether it’s Excel, a budgeting app, or another method that suits your preferences. Distinguish between needs and wants to prioritize essential expenses. Keep bills and receipts organized. This is especially important if you have a PSNT. Prioritize debt repayment to reduce financial burdens over time. Keep the future in mind by planning upcoming expenses and savings goals. Remember to factor in fun within your budget. Adopt the principle of saving first before spending to build a robust financial foundation.

Step 5: Monitor Your Budget

To stay on top of your finances, review your budget monthly to avoid surprises. Stay organized and keep your receipts handy. Use forward thinking when planning your expenses. Maintain a calendar of annual events, such as dentist and eye doctor appointments and car registration. Plan ahead for vacations and travel by setting aside money in advance. Don’t forget about the holidays; plan spending and spread it across the year or save accordingly. Revise the plan in the event of life changes. Finally, conduct an annual review of benefits to ensure you are maximizing everything available.

Other Things to Consider

Do you have a Letter of Intent?

This could help map out future needs and wants and develop a lifespan budget, especially for those individuals that might need more support such as guardianships and residential placement programs.

Are you maximizing all available benefits?

Knowing your benefits and how they work together can help maximize your overall budget.

Are you currently receiving Medicaid or SSI?

These benefits are means tested and offer medical insurance, however they are often lower amounts and have limitations such as in-kind support and maintenance that need to be considered.

Are you employed or do you want to work in the future?

Individuals living with disabilities have many employment opportunities and supports. This does not always mean they will lose their benefits. Make sure to know all the programs offered and make the right decision between working and not, and how it may have an impact on your overall income.

What is your long-term financial goal?

This comes down to lifestyle. Knowing what your long-term goals are can help guide you to a better financial future while also improving your quality of life.

Will the individual need a Representative Payee or Guardian?

Understanding the individual’s ability to manage their funds is essential to long-term planning success. Consider professional services vs. family members, and think long-term, who will be the successor if using a family member.

Does the individual need a PSNT or ABLE account?

Leveraging programs such as Special Needs Trust and ABLE accounts can help to extend your budget without having an impact on your benefit eligibility.

Crafting a budget that matches individual needs is pivotal for effective future planning. A financially stable future is based on robust foundations. Investing sufficient time to explore your essential and non-essential expenses, along with all available benefits and resources, is a vital step in the process. It’s crucial to stay flexible and revise your budget regularly to align with your current needs. If this seems overwhelming, consider seeking professional services for assistance. Establishing a financial plan provides peace of mind, ensuring you’re well-prepared for any future expenses and needs.